One of my reporter friends just asked me if I’d done the math on what a person could owe in taxes if they’d been in the Colorado Unemployment system. I have another post on all the add-ons that people weren’t expecting to see in their 1099Gs. Many were surprised by up to $12,375 that was taxed in addition to their weekly benefit. (I won’t even go into how many are surprised that unemployment in general is taxed….it’s why you are given the option to have them take out taxes before sending to you.)

Well, this time around, I’m adding in what a person could have received total on their 1099G. Let’s assume it’s someone who, like my husband and I, work in the live entertainment industry. We were among the first to begin losing work, which most of us remember as Friday the 13th (of March 2020). Even at that point, my husband’s last several jobs were to load OUT shows that were ending early. Not because of any government shutdown, but because international and national corporations were seeing the writing on the wall.

So, I made sure Mike signed up for unemployment on March 13th. He actually got a 4 hour call for two days later, to load out Spongebob Squarepants the musical at the Buelle. That poor 4 hour call kinda screwed us up a little, but more on that later.

Mike was deemed eligible for a full 26 weeks of standard Unemployment Insurance (UI). Let’s use his situation as an example, but with the maximum weekly benefit possible in Colorado, $618 per week. (Many people do not receive the maximum amount, based on what they earned the year before, and many – myself included – don’t meet the threshhold for a full 26 weeks, but let’s go with the max possible here.)

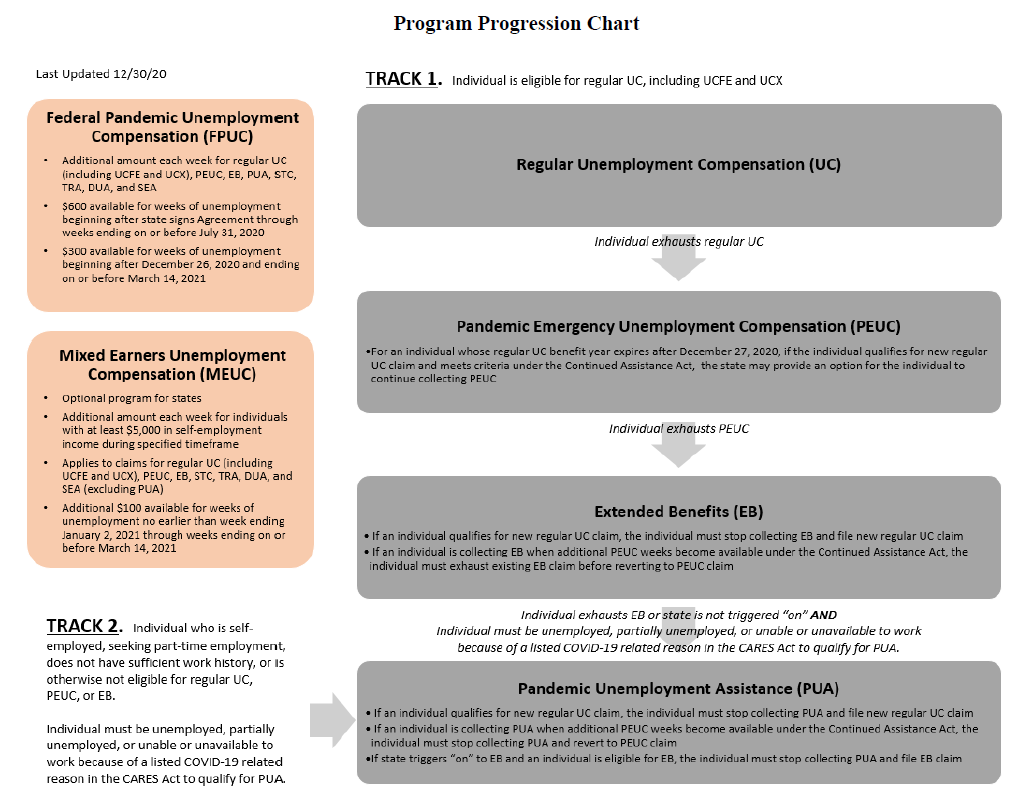

After UI, there is a pandemic extension available of Pandemic Emergency Unemployment Compensation (PEUC), for up to 13 more weeks. Here’s a chart published from federal guidelines explaining the progression of benefits (this one is applicable to the stimulus for December 27 and on into 2021, but the process is still pretty much the same). We’re following Track #1 here.

After that, State Extended Benefits (SEB) may be available for up to 13 more weeks. However, in this scenario, they were triggered off in Colorado when the original unemployment rate dipped.

After SEB, those in Track #1 of regular unemployment can end up the same place as Track #2 people, Pandemic Unemployment Assistance (PUA)

| Program | Amount | # of Weeks | Total | Notes |

| UI | $618 | 26 | $16,068 | Not everyone received the maximum weekly allowed, and many were not eligible for the full 26 weeks |

| PEUC | $618 | 13 | $8,034 | Again, not everyone received a full 13 weeks |

| PUA | $618 | 2 | $1,236 | In this scenario, 2 weeks of PUA would have been available through 12/26/20. |

| FPUC | $600 | 17 | $10,200 | March 29 through July 25 for Colorado; some states had fewer weeks |

| LWA | $300 | 6 | $1,800 | July 26 to September 5; some states had fewer weeks |

| $37,338 |

Now, with that 4 hours of work Mike had, they only subtracted a little from his benefits that week BUT he then had one week with ONLY that amount that was taken out, before he could switch to PEUC. We then had to deal with a backdate request based on when he hit $0 and getting into PEUC. The backdate was then delayed until the first week of January. At that point, we were shy of receiving money for the last week of the first stimulus. Had he not worked, he would have been eligible for 2 weeks of PUA. We didn’t bother applying for that 1 week he could have gotten backdated. However, if someone had applied March 13th, and not worked since, by my calculations they would have been eligible for 2 weeks PUA before federal funds expired. Anything from 12/27 forward was for the week ending 1/2 and thus would be on 2021 taxes.

Additionally, there was a one-time $375 Colorado Stimulus, but it is only for those who made less than $500 per week. That is not applicable to this scenario of someone making the full weekly benefit.

So – had someone been in live entertainment, and joined Colorado’s unemployment system on that Friday the 13th, they could be looking at a 1099G that totals $37,338. Unemployment pulls out roughly 14% in combined federal and state taxes – though that does not mean it equals what their actual tax bracket liability will be. But let’s just say that some people who did not opt to take out taxes could currently be looking at $5,227 in taxes they owe, by very rough calculations.

There is a legislative bill being discussed to remove the liability of that 17 weeks of FPUC, but nothing has been passed at this time. It would “would remove taxes on up to $10,200 in unemployment aid for the 2020 tax filing year.“

UPDATE: A Facebook group member added that in addition to these taxes they knew they would have to make up, what they had NOT realized was it would wipe out their Earned Income Tax Credit that they count on every year.